DOUBLE STANDARDS?

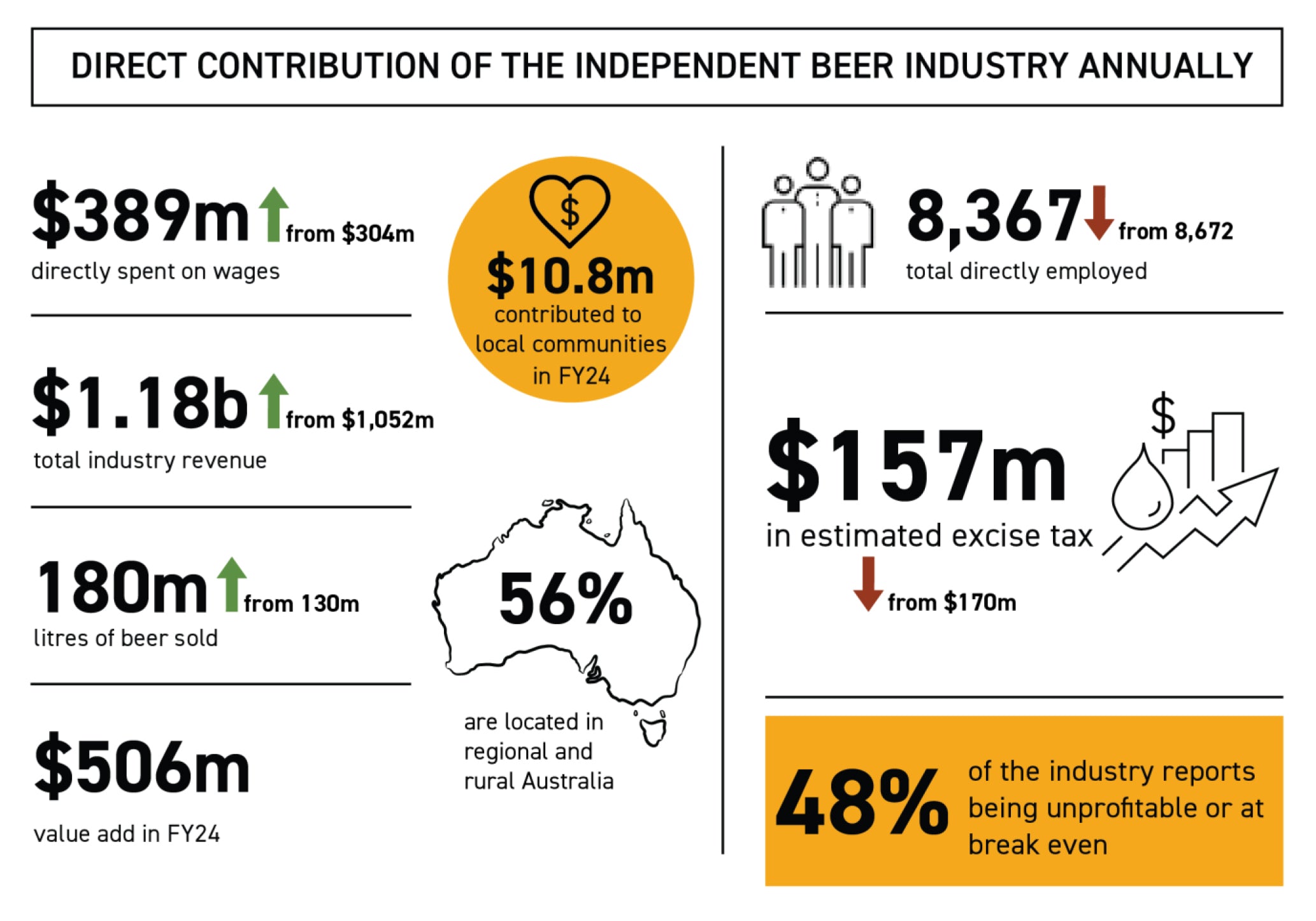

According to a recent article by the Independent Brewers Association, Australia has the third highest taxation on beer in the world. What’s perhaps more striking is that this excise tax is raised twice a year, while the same tax on wine has remained the same since 1999.

These taxes are seemingly here for a reason: alcohol can cause undeniable damage to the community, which these excise taxes are meant to help alleviate. However, when comparable products aren’t subject to the same conditions; two large, foreign-owned breweries have 83% of the beer market share; and craft breweries routinely collapse under financial pressures, the continued increase of this tax begins to feel not only arbitrary but irresponsible.